Baixe o App

-

- Plataformas de Trading

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Condições de Trading

- Tipos de Conta

- Spreads, Custos & Swaps

- Depósitos & Retiradas

- Taxas & Encargos

- Horários de Trading

Baixe o App

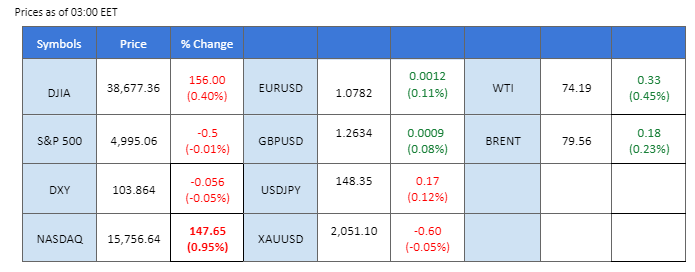

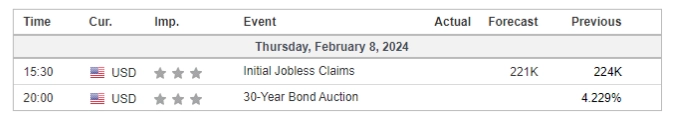

Several Fed officials have made consistent statements following last week’s interest rate decision and the disclosure of the Nonfarm Payroll. Jerome Powell and his colleagues have emphasised that the strength of the labour market and economic conditions suggest that a cooling period will take some time, and the U.S. central bank may need to prolong the current monetary tightening policy. However, the dollar index is struggling to find support above the 104 level, impacting gold and oil prices in an uptrend trajectory. The Chinese CPI and PPI readings were released, showing lower-than-expected figures, casting a shadow on China’s economic condition and weighing down oil prices in the long run. Meanwhile, the Chinese equity markets, including the Hong Kong stock market, were affected by the downbeat inflation data.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (82%) VS -25 bps (18%)

(MT4 System Time)

Source: MQL5

The Dollar Index takes a step back from its resistance level as the US market experiences a relatively quiet week. Investors, in the absence of significant catalysts, opt for profit-taking while eagerly anticipating fresh economic data and listening for more nuanced remarks from Federal Reserve policymakers. The overnight commentary from various Fed speakers underscores a measured approach to potential policy easing, adding layers of complexity to the unfolding market dynamics.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 53, suggesting the index might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 104.60, 105.65

Support level: 103.85, 103.05

Rising geopolitical tensions trigger a shift in sentiment towards the safe-haven asset, gold. Although gold prices initially rebound, they experience retracement as some investors anticipate the Federal Reserve’s potential extension of its tightening monetary policy in the long term. The overall outlook remains unclear, urging investors to closely monitor fresh economic data from the United States, statements from the Federal Reserve, and ongoing geopolitical tensions for nuanced trading signals.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The GBP/USD has gained ground and broken above its resistance level, suggesting a potential trend reversal for the pair. Despite consistent hawkish statements from Fed officials regarding their near-term monetary policy, the dollar’s strength has been lacking, possibly influenced by lacklustre treasury yields. Meanwhile, as the UK’s inflation rate remains high, it is less likely that the Bank of England (BoE) will start cutting its interest rate anytime soon, which is supporting the strength of the Sterling.

GBPUSD rebounded strongly and has broken above its resistance level, suggesting a potential trend reversal for the pair. The RSI rebounded sharply while the MACD approaching the zero line from the bottom suggests a bullish momentum is forming.

Resistance level: 1.2710, 1.2785

Support level:1.2610, 1.2530

The EUR/USD has continued to edge higher marginally and has broken above its resistance level at 1.0775. The pair has mainly gained on the back of the easing dollar strength. The German Industrial Production released yesterday came in at -1.6%, which is lower than the previous reading of -0.2% and contradicts the upbeat German Factory Order data. Traders are eagerly awaiting next week’s Eurozone GDP data to gauge the Eurozone’s economic conditions and the euro’s strength.

The EUR/USD has broken above the resistance level, suggesting a potential trend reversal for the pair. The MACD has crossed at the bottom and is rising while the RSI has been moving upward, suggesting a bullish momentum is forming.

Resistance level: 1.0866, 1.0954

Support level: 1.0700, 1.0630

The upward momentum in the US equity market persists, with the S&P 500 reaching yet another record high. This bullish trend is fueled by positive corporate earnings reports, notably from industry giants such as Ford Motor Company, Uber Technologies, and Chipotle Mexican Grill Inc. Ford’s impressive annual guidance and fourth-quarter performance, Uber’s achievement of its first-ever annual operating profit, and Chipotle’s exceeding of quarterly expectations all contribute to the overall optimism in the market.

Dow Jones is trading higher following the prior breakout above the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 64, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 39280.00, 40000.00

Support level: 37815.00, 36660.00

The USD/JPY pair is hovering closely to its strong resistance level at 148.72, attempting to break above such a level. The dollar has lost some of its bullish momentum recently, but the Japanese Yen has traded softly against the lacklustre dollar. Fed officials have consistently given hawkish statements, which potentially may drive the dollar to trade higher. Traders will closely monitor further developments to gauge the direction of the USD/JPY pair.

The pair has traded closely to the resistance level and is attempting to break above. The RSI has been hovering in the upper trajectory, but the MACD has moved downward slightly, suggesting the bullish momentum is lacking.

Resistance level: 148.67, 151.75

Support level: 146.75, 145.21

The NZD/USD pair experienced a strong rebound and broke above its downtrend resistance level, suggesting a potential trend reversal for the pair. Despite the hawkish tone from the Fed, the U.S. dollar has been lacking momentum. Additionally, the New Zealand inflation expectation data set to be released today (8th Feb) will be closely watched by traders to gauge the strength of the Kiwi.

The pair rebounded from its bearish trend and has broken above its long-term downtrend resistance level, suggesting a potential trend reversal for the pair. The RSI has been gaining while the MACD has broken above the zero line from below, suggesting a bullish momentum gain.

Resistance level: 0.6150, 0.6210

Support level: 0.6095, 0.6050

Crude oil prices witness an extension of gains as hopes for a Gaza ceasefire deal are dashed after Israel’s Prime Minister, Benjamin Netanyahu, rejects the proposal from Hamas. Bloomberg reports Netanyahu’s dismissal, citing Hamas’ “delusional” demands and a perceived lack of commitment to negotiations. The situation raises concerns about the potential broadening of the conflict, heightening the risk of disruptions to crude supplies. The evolving geopolitical landscape becomes a crucial factor influencing oil market dynamics.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 75.20, 78.65

Support level: 71.35, 68.35

Trade forex, indices, Metais, and more at industry-low spreads and lightning-fast execution.

Registe-se para uma Conta PU Prime Real com o nosso processo sem complicações

Financie sem esforço a sua conta com uma vasta gama de canais e moedas aceites

Aceda a centenas de instrumentos em condições de negociação líderes de mercado

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!