Baixe o App

-

- Plataformas de Trading

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Social

-

- Condições de Trading

- Tipos de Conta

- Spreads, Custos & Swaps

- Depósitos & Retiradas

- Taxas & Encargos

- Horários de Trading

Baixe o App

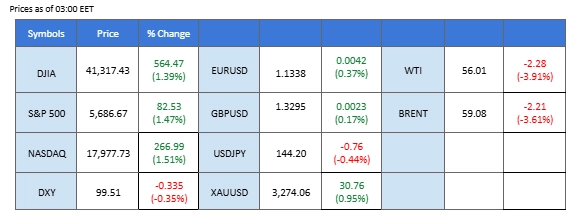

Market Summary

Markets traded mixed on Friday as investors digested stronger-than-expected April U.S. jobs data, which offered tentative relief following a week of downbeat economic prints. Nonfarm payrolls rose by 177,000—beating expectations of 130,000—while the unemployment rate held steady at 4.2%. Solid hiring in healthcare and logistics offset a decline in federal jobs, suggesting the labor market remains resilient despite macro headwinds. Average hourly earnings rose 0.2%, keeping annual wage growth at 3.8%, consistent with slowing but sticky inflation.

Equities hovered near recent highs, with the NASDAQ 100 extending gains on momentum from tech earnings. However, broader risk sentiment stayed cautious, as investors weighed whether today’s report reduces the urgency for Fed rate cuts or simply delays the pivot.

The U.S. dollar firmed modestly, with the DXY holding just above 100.00 as rate cut bets were pushed further into H2 2025. Treasury yields ticked higher post-NFP, reflecting diminished odds of a near-term dovish shift. However, market focus remains on upcoming CPI and Fed commentary for confirmation.

In commodities, oil prices held above $60 on supportive supply-side headlines from OPEC+, while gold slipped slightly as traders reduced defensive positioning.

With April’s jobs data clearing a key hurdle, markets turn to next week’s inflation readings and Fed Chair Powell’s remarks for clarity on the policy path. For now, NFP data appears to validate the “soft landing” narrative—but volatility remains tethered to trade rhetoric and geopolitical risk.

Current rate hike bets on 7th May Fed interest rate decision:

0 bps (92.3%) VS -25 bps (7.7%)

Source: CME Fedwatch Tool

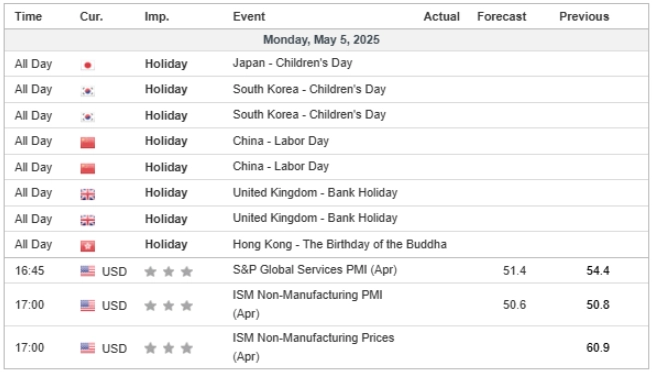

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index briefly surged above the critical 100.00 resistance level following Friday’s stronger-than-expected U.S. nonfarm payrolls report, which showed job gains of 177,000—significantly above consensus forecasts. The robust labor data bolstered expectations that the Federal Reserve may maintain a hawkish policy stance, in contrast to President Trump’s recent calls for rate cuts. U.S. Treasury yields continued to rise in response, lending further support to the greenback’s strength.

The dollar index continues to trade within a higher-high price pattern, suggesting a bullish bias for the index. The RSI remains at above 50 level while the MACD remains at above the zero line, suggesting that the index remains bullish.

Resistance level: 101.40, 104.25

Support level: 99.10, 96.35

Gold prices edged lower as risk appetite improved following better-than-expected U.S. Nonfarm Payrolls, which came in at 177K vs. 138K expected, suggesting ongoing labor market strength. Sentiment was further supported by President Trump’s comments on China, where he signaled willingness to lower tariffs, acknowledging that high levies have effectively stalled trade between the two nations. He also described China’s recent remarks as “positive” but emphasized that any deal must be “fair.”

Gold prices are trading flat while currently consolidating in a zone between support and resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 49, suggesting the gold might tilt toward bullish bias, but improving risk appetite might weigh on gold prices.

Resistance level: 3270.00, 3355.00

Support level: 3200.00, 3110.00

GBP/USD remains under pressure, falling below the 1.3300 handle as a resilient U.S. labor report strengthened the dollar and weighed on rate cut expectations. In contrast, UK economic indicators continue to soften—highlighted by a seventh consecutive month of contraction in manufacturing PMI. Markets now price in around 100 bps of BoE easing this year, deepening the divergence with a Fed that is seen on hold until at least mid-2025.

GBP/USD continued to consolidate below recent highs, holding beneath key resistance near 1.3340 and reflecting a neutral-to-bearish undertone. RSI is hovering just below the 50 mark, indicating subdued momentum and lack of clear directional strength. Meanwhile, the MACD remains slightly below the zero line with the signal line converging, suggesting indecision but lingering downside bias.

Resistance level: 1.3340, 1.3420

Support level: 1.3270, 1.3185

EUR/USD struggled to hold recent gains as resilient Eurozone inflation was overshadowed by a stronger U.S. labor report, which reduced expectations for near-term Fed rate cuts and supported broader dollar strength. While April’s core CPI in the Eurozone edged higher, services inflation remains elevated, complicating the ECB’s path to easing. Meanwhile, concerns over weak growth and stagnant industrial activity continue to cap euro upside, particularly against a dollar supported by firmer yields and relative economic resilience.

EUR/USD is attempting to stabilize after rebounding modestly from recent lows, though upside momentum remains limited as the pair trades below key resistance. The RSI is hovering near the neutral 50 level, suggesting a lack of directional conviction, while a slight uptick signals a pause in bearish pressure. Meanwhile, the MACD is flat just below the zero line, with the signal line showing minimal divergence—pointing to indecisiveness and a wait-and-see tone.

Resistance level: 1.1430, 1.1540

Support level: 1.1285, 1.1190

U.S. equities trended higher as investors welcomed resilient job data, which pointed to a still-strong economy despite trade-related uncertainty. The 177K job gain was only slightly below the prior month’s (revised down to 185K) and beat consensus forecasts. Hopes for revived US-China trade talks added further support, after China signaled openness to dialogue—conditioned on mutual sincerity and removal of tariffs.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 66, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 20100.00, 21005.00

Support level: 19455.00, 18815.00

USD/JPY extended its advance as renewed yen weakness followed dovish Bank of Japan signals and a firm U.S. labor print, reinforcing policy divergence and risk-on momentum.Governor Ueda’s cautious tone, combined with downgraded domestic growth projections, reinforced expectations that the BoJ will lag behind other central banks in tightening. On the U.S. side, stronger-than-expected April jobs data boosted confidence in the Fed’s patient stance, pushing Treasury yields higher and supporting the dollar. Improving global risk sentiment further weighed on the yen, reducing demand for traditional safe havens.

USD/JPY is pulling back after failing to extend gains above a key resistance zone, suggesting waning bullish momentum in the short term. The RSI has dipped toward the 50 level, indicating a moderation in buying pressure, while the MACD has crossed below the signal line with fading histogram bars, reinforcing the loss of upward momentum.

Resistance level: 147.15, 151.15

Support level: 143.95, 140.45

Crude oil came under pressure as OPEC+ approved another large output increase, adding more than 400,000 barrels per day in June—mirroring May’s unexpected hike. The move raised concerns about a global supply glut, particularly as demand faces headwinds from ongoing trade tensions. OPEC+ also shifted focus to penalizing overproduction from members like Kazakhstan, adding further instability to the market. The rollback of prolonged output curbs has cost the group market share, and the price reaction has been bearish.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 31, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 65.25, 71.75

Support level: 55.35, 52.20

Trade forex, indices, Metais, and more at industry-low spreads and lightning-fast execution.

Registe-se para uma Conta PU Prime Real com o nosso processo sem complicações

Financie sem esforço a sua conta com uma vasta gama de canais e moedas aceites

Aceda a centenas de instrumentos em condições de negociação líderes de mercado

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!